An expert witness is an individual who possesses the specialized skills & knowledge about a topic or has sufficient experience to testify in court about what they believe has occurred. Expert witnesses can be instrumental in legal matters and hearings. Plaintiffs and defendants are often encouraged to hire expert witnesses for their cases for a more thorough and comprehensive examination of available data. How Are Expert Witnesses Different from Regular Witnesses? Their specialized skills are what set them apart from regular witnesses. Unlike the latter, expert witnesses do not rely on what they have personally seen, heard, or felt when presenting their testimony. They are usually completely removed from the case and have no personal connection to it. Their testimony is solely based on their training, knowledge, and experience in their field of expertise, which allows them to draw conclusions and give professional opinions about the case. An expert witness studies the case and takes in all of the available information. They analyze it and using their training, experience, and knowledge, provide their opinions, which could take place in a deposition or court. What Is the Role of an Expert Witness? As mentioned above, expert witnesses are not usually emotionally involved in the case and are independent forces.They are unbiased witnesses who do not let their emotions or personal bias get in the way of their opinions and conclusions. Their testimonies are free of prejudices and based solely on concrete facts and critical evaluation. As a result, expert witnesses are viewed as reliable and objective during a case. It is important to note that expert witnesses are not advocates for their clients. Their opinions are their own, unaffected by any external forces or influences. Their conclusions are supported by their training, education, experience, and industry standards. Why Should You Hire an Expert Witness for Your Case?If you are dealing with a real estate case or a banking case, having an expert witness to educate you on the industry standards and practices can help tremendously. Their knowledge and experience can make all of the difference in a case. They can explain practices, relevant theories,and concepts to the judge and the jury in a way to help educate the court.

An expert witness will also be able to pick up on any inconsistent findings, inaccurate details, or improper methodologies in the opposing party’s reports. In need of a banking or real estate expert witness?Contact Jason D Koontz today for his independent expert witness consulting services in Fort Worth!

1 Comment

Real estate feuds are all too common in the US. They may arise due to poor planning, breach of contract, and often need to be resolved in court. For this, you may need an expert real estate witness. What are a few things to look out for when hiring an expert witness for your case? Let’s take a look. Knowledge of the local market Each neighborhood can have its own set of zoning laws and regulations covering residential and commercial properties. When hiring an expert witness for your case, you need to make sure that they are knowledgeable about the local rules and regulations relevant to your case. Let’s say that the expert witness you’re interested in lives and worksin Dallas. Your matter, however, is based in Chicago, and you need appraisal expert services in your city. In this case, it’s imperative that your expert witness is knowledgeable of the Chicago, Illinoismarket Unless the expert witness has competency in the subject’s market, they will be opening themselves up to criticism or even removed from the case as an expert. For their testimony to be credible, they should be competent in the subject’s market. Experience in Real Estate Experience is yet another quality you should look out for. The more experienced an expert witness is, the more credible their testimonywill be. An appraised with years of experience should have a greater knowledge of industry trends and standards. Consequently, they’d be able to present a more credible opinion. Experience doesn’t only include the number of years an expert witness has under their belt, however. It encompasses the number of years they’ve spent working in a specialized field. In this case, it refers to the experience they have working in real estate. Ability to Provide Relevant Documentation & Statistical Support Finally, a real estate expert witness should be able to back up their conclusions and opinions with a credible report. A qualified expert witness will have no trouble presenting documentation that supports their claims, and may even be able to obtain information that you may not have access to. Their insights and explanations will be based on these documents. They must also possess the ability to read and analyze complex texts presented in court by the opposing party. Property valuations, appraisal reviews, and investment analyses are just a few things an expert witness should be able to decipher and discuss.

Need a real estate expert witness for your case in West Virginia? Contact Jason D Koontz today for his independent expert witness consulting services. If you need a USPAP compliance review, he offers those services across the nation, including Dallas, Fort Worth, Chicago, New York, and Philadelphia! Also, as a former banker, he can offer banking expert witness services. Approximately forty percent of marriages in the United States end in divorce. The divorce rate is attributed to several reasons and often results in complicated legal disputes. How can a real estate expert witness be of help during a divorce? Here’s why you should hire one during the proceedings. Divorces Can Be MessyLet us be honest; divorces can be messy and stressful. As much as you may want to have an amicable divorce, sometimes this isn’t possible. If both sides are unable to reach an agreement, they may end up with unusual settlements. If you think there is a chance of your divorce proceedings being unpleasant and real estate is involved, it’s best to hire a real estate expert witness early in the process.An unbiased opinion regarding the real estate value is one less thing to argue about when splitting assets. Even seemingly amicable divorces can take a turn for the worse when topics,such as the value of the real estate,are discussed. It is better to have a real estate expert witness involvedbefore things get sour, rather than look for one afterward. They Provide Unbiased RepresentationReal estate expert witnesses provide neutral, objective, and unbiased representation. Experts are not emotionally connected to your case, and thus, have no prior biases. An impartial opinion helps your case because their testimony is based on the market, available data, and their training and, not their relationship with you.

Need a real estate expert witness for your divorce proceedings in West Virginia? Get in touch with Jason D Koontz today for his independent expert witness consulting services. He also offers banking expert witness services as well. An expert witness can assist an attorney before a deposition or trial. An expert can help an attorney understand the issues and if standard industry practices were followed. The expert has specialized knowledge, experience, training, and skill that qualifies them to form opinions for a case to assist with the litigation and preparation for trial. However, the court must find the expert’s qualification sufficient and the opinions relevant to the case to allow them in the court. It is essential to understand that an expert witness can only offer opinion testimony, which distinguishes them from fact witnesses. So, the opinions given by the expert will be considered opinion evidence rather than factual evidence. Here are some common mistakes expert witnesses are often guilty of making which can render their opinion not as helpful to the case as it could have been: Relying Completely on The Information Given by The Lawyer An expert witness should ask for a written agreement that defines the scope of the case as well as the purpose of engagement for the expert. Even with a written agreement in place, the expert should avoid accepting the lawyer’s words blindly regarding the critical aspects of the project and research everything thoroughly before agreeing to testify. This will ensure that there is no bias coloring the testimony of the witness, and the attorney doesn’t mold or restrict the expert’s work to present a favorable opinion. Forgetting That They Are an Advocate Only for Their Opinions and Not for The Case Itself Expert witnesses, much like fact witnesses, should make sure the testimony and opinion therein are true, to the point, and sincere. The witness must be objective and should only let their training, education, and experience guide their opinions. They should focus on the research and facts to form their opinions, even if they are not exactly what the client or lawyer wants. It is the lawyer’s job to advocate the case and take sides. If the expert tries to fit the opinions with the objective or goals of the lawyer’s case, they risk losing their credibility. Trying to Sound Like the Ultimate Expert on Everything Less is always more, and that is also true when forming an opinion as an expert witness. An expert should always be careful about the information they are sharing, what they put in writing, and especially coloring facts with personal bias. They should also be aware of the danger of trying to sound like the ultimate expert. Even experienced lawyers and people who have been offering services as experts avoid acting superior and talking down to others. Keeping an open mind and being sincere is essential. It is also essential to consider the advice and guidance of older and wiser attorneys and experts in the field. Remember, you don’t know everything, nor do you have the same experience as others, so make sure you have argued all sides before making up your mind about a particular aspect of the case. Find Banking Expert Services for Your Case in New York Jason Koontz, CRC, is a former Senior Vice President and has over 20 years of experience in the banking sector. He is an independent expert and offers his expert witness consulting services to lawyers in New York. He has served as an expert and litigation support specialist on over 150 cases on a broad range of banking and real estate matters, including lender liability, commercial loans, debt collection, predatory lending, and more.

Contact him today by calling at (646) 397 – 3835 or connect with him via email at jasonkoontz1@gmail.com Disclaimer: This blog is for informational and educational purposes only, does not constitute professional advice. I’m not liable or responsible for any damages resulting from or related to your use of this information. The Difference Between Preparing and Coaching Your Banking Expert Witness—and Why It’s Important7/13/2020 Expert witnesses bring a sense of objectivity to court proceedings that bears much influence on the outcome of the case. Therefore, lawyers should pay special attention to their expert witnesses and help them prepare for trial, so the judge and jury will understand and rely upon the expert’s testimony. However, there’s a difference between expert witness preparation and coaching, and it’s critical to understand the difference between both methods to avoid crossing that line. Here are a few thoughts for consideration: Understanding the difference between preparing and coaching your banking expert witnessBanking Expert Witness Preparation Working with your banking expert witness is entirely acceptable from an ethical and legal standpoint. It can prove to be very important to the success of your case. It can range from briefing your expert on the trial venue and the participants to sharing with them the facts most important to your matter. An attorney should lay out the particulars of the case and discuss what specific areas the expert should be prepared to provide opinions. Moreover, lawyers can discuss ways to boost the credibility of their banking expert witness as a part of the preparation process, without raising any concerns. Make sure that your expert studies the facts of your particular matter. It is crucial that the expert has a firm understanding and has reviewed the documents produced. An expert that freely offers opinions on an issue without a firm grasp of the case specifics can lose credibility quickly or, even worse, be excluded from the case. Witness preparation is a time that can be used to make your expert carefully consider their testimony and make any necessary changes, which will create a better connection with a judge and jury. An expert needs to strike that critical balance between educating the jurors without sounding condescending and establish a connection to them that will strengthen their credibility. Jurors are people too, and the expert should be reminded that after sitting in a courtroom for an extended time, a juror can have a short attention span. As a result, the expert should try to deliver the most important themes early on in their testimony before a juror is distracted, or their mind drifts off to something else. Be sure to encourage the expert to review the critical parts of the material related to their testimony and practice possible answers. The better they know the case and the relevant facts, the more confident they will be when they are on the witness stand. Last, remind your expert to be direct and answer the question to the best of their ability. Experts are not expected to know everything. Remind them that its ok to say, “I don’t know,” if that is true. Jurors are people too and prefer an honest witness to one who is trying to be witty or evasive with their answers. Banking Expert Witness Coaching Coaching your banking expert witness is an unethical approach that could include asking them to obfuscate the truth. Instructing the witness to be misleading could lead to severe legal consequences and weaken a case. If it is discovered that a lawyer has coached a witness to mislead the court—they could be charged with suborning perjury while the witness could be charged with perjury. An honest and ethical expert witness will never omit essential facts or critical information to support a specific case theory. Why is it important to learn the difference? It’s critical to prove to the court that your expert banking witness is invited to provide an objective opinion, which isn’t biased in your client’s favor. Therefore, lawyers should tread carefully and make sure they don’t coach their witnesses to answer questions of opposing counsel in specific ways to twist the facts. The testimony of your bank expert witness largely depends on their credibility, and any attempt to influence their opinion can significantly damage your case. Hire an experienced and objective banking expert witness It’s essential to hire an experienced and objective banking expert witness to ensure their testimony holds high value in front of the judge and jurors. Ideally, you should find an expert with a background in the banking sector, with extensive knowledge of the financial industry, and prior experience in providing expert witness services. An experienced expert witness is deemed more credible and doesn’t require extensive preparation, which minimizes the risk of coaching. Further, you can also review their previous engagements to see how they handled prior depositions and trial testimony. Was the expert able to communicate their knowledge of the subject effectively without sounding like a professor who wants to impress everyone? Were they able to answer the questions and communicate without lengthy answers and technical jargon that confused the audience? Conclusion Preparing an expert witness is an essential component of trial preparation. The tips in this article will help your expert testify in a way that connects with a jury, and serve as a critical asset at deposition or trial.

Jason D. Koontz is a former banking Senior Vice President with over 20 years of lending, cash management, and bank operations experience. He has vast hands-on experience in bank lending practices, deposit accounts, and matters involving residential real estate. Mr. Koontz has extensive, coast-to-coast, experience as an expert witness (retained in over 150 matters). He has served as an expert witness in cases involving commercial loans, residential mortgages, predatory lending, debt collection, underwriting, consumer protection, fraud, truth in lending, lender liability, loan servicing, deposit accounts, residential property valuation, and USPAP compliance. He has been engaged in multiple matters where predatory and abusive loan practices were alleged. Mr. Koontz has extensive testifying experience at deposition and trial. He can be reached at (646) 397 – 3835 or by email at jasonkoontz1@gmail.com. ALSO READ: UNDERSTANDING THE RISKS FACED BY YOUR START-UP BUSINESS Disclaimer: This blog is for informational and educational purposes only and does not constitute professional advice. Jason Koontz is not liable or responsible for any damages resulting from or related to your use of this information. An expert witness provides an impartial testimony to the court. It can help the judge and jurors understand complex and nuanced information more effectively—their expertise and testimony also lend strength to a case. Including an expert witness on your legal team to educate all of the parties involved can shed light on the various aspects of the matter. Choosing the right expert can go a long way in terms of assisting you in obtaining a favorable outcome for your client. Here are five essential qualities that a banking expert witness must possess to maximize the chances of success: ExperienceExperience should be at the top of the list when you begin the search for a banking expert witness to ensure you found a strong choice for a testifying role. They must have unquestionable credentials and in-depth knowledge of the financial and regulatory issues related to your matter. It will allow them to successfully navigate the intricacies involved in the case. An ideal banking expert witness will have a background in the banking industry and a history of serving as an expert in many cases. Confidence Confidence is another essential trait that a banking expert must possess to come across as credible and trustworthy in front of a judge or jury. You should not give a court any reason to doubt your expert witness. You need a professional who can hold their ground and remain steady when cross-examined by opposing counsel. A confident expert witness will be able to articulate their opinion concisely and present themselves as credible and reliable to those listening to their testimony. Effective Communication A banking expert witness should have excellent communication skills and familiarity with industry jargon to deliver their point effectively. More importantly, they must be able to speak without hesitation or reading pre-written notes or records--it adds more weight to their position. A professional with relevant work experience will be able to understand the technical language and formulate their argument more cohesively. Further, it means more to those listening when an expert can say that they have dealt with very similar situations and have first-hand knowledge and experience in this type of matter. An inexperienced witness or one that melts under pressure can cause harm by confusing a judge or jury in a way that can lessen the chances of a positive outcome for your client. The ability to find an expert with expertise, relatability, and one who can communicate effectively is important. Attention to Detail In complex banking transactions, the smallest details matter. Whether it’s a complex mortgage loan underwriting matter in New York or providing an opinion on a predatory mortgage loan in Chicago, experts must exercise close attention to detail. Often, attention to detail can influence the outcome of the case and prove to be the difference between a successful or failed outcome. Therefore, you must look for someone with years of experience in your matter, whether it be commercial lending, mortgage lending, lender liability, bank operations, or cash management. If you are dealing with a real estate related matter, if they understand the real estate industry, that is even better. Reputation and trustworthiness Last but certainly not least, you must ensure that your banking expert witness has unquestionable ethics and a solid reputation.

They should be able to provide objective opinions and refrain from making any favorable comments that may undermine the credibility of their statement. An expert witness is there to educate the parties involved and not as an advocate for their client. They should uphold high moral standards and display integrity. Moreover, they must be well-groomed and professionally dressed for the court and must be able to speak with confidence. If you’re looking for expert witness consulting services in New York, get in touch with Jason Koontz. With 20+ years of experience in the banking and financial sector, Jason brings both knowledge and a strong sense of duty to the court as a consultant and banking expert witness. To find out more details, call (646) 397 – 3835 or send an email at jasonkoontz1@gmail.com. ALSO READ: UNDERSTANDING THE RISKS FACED BY YOUR START-UP BUSINESS Disclaimer: This blog is for informational and educational purposes only, does not constitute professional advice. I’m not liable or responsible for any damages resulting from or related to your use of this information. The Potential Impact of Expert’s Credentials on Your Case—and When Is an Expert Witness Required?7/13/2020 Expert witnesses are an essential and frequently essential component of many civil litigations. The credentials of an expert witness can influence the verdict of your case. The education, professional experience, and credibility of an expert serve as a basis for acceptance of their testimony. In this blog, we will discuss the potential impact of an expert’s credentials on a case and learn when is an expert witness required. Expert’s Credentials—a brief outlookEducation background The educational background of an expert witness can play a significant role in establishing their credibility in the court. For example, the judgment of a professional with a degree in the area of the matter will weigh more due to proven educational record. Professional experience An expert witness with relevant experience and professional background in a similar industry can significantly improve their standing. For instance, the testimony of an expert witness with years of experience in the banking industry will hold high value in litigation involving a predatory lending or lender liability matter. Continued professional development Expert witnesses with a track record of continuous professional development are deemed more credible, which can help strengthen your case. It may include obtaining certifications and attending conferences and seminars as it shows they remain updated in their field of expertise. Career Progression The career progression speaks about the knowledge and expertise of an expert witness. A professional who climbed up the ladder in their professional life is likely to have developed broad areas of expertise, which adds more substance in their opinion. Prior testifying experience The prior testifying experience of an expert witness can also provide them an edge. A jury might consider the credibility of an opinion based on their previous history as an expert witness. An expert with a background of providing several testimonies may be regarded as more reliable. When Is an Expert Witness Required?Expert witnesses are required to provide testimony regarding matters requiring technical or specialized knowledge that is beyond the expertise of a layman.

Expert witnesses rely on the appropriate evidence and use specific methods to arrive at an opinion, which may include researching, testing, and other evaluation methods. The conclusion that expert witnesses reach as a result of their assessment help judges and juror to understand the case better and reach a verdict. Are you looking for expert witness consulting services in New York? Contact Jason Koontz today! With more than 20 years of experience in the banking and financial sector, Jason brings a wealth of knowledge and expertise to the court as a consultant and expert witness. For more information, give us a call at (646) 397 – 3835 or send an email at jasonkoontz1@gmail.com ALSO READ: UNDERSTANDING THE RISKS FACED BY YOUR START-UP BUSINESS Disclaimer: This blog is for informational and educational purposes only, does not constitute professional advice. I’m not liable or responsible for any damages resulting from or related to your use of this information. by Jason Koontz, CRC Opportunity and risk are two sides of the same coin when starting a new business. Entrepreneurs gain an edge when they grasp this basic concept and put sensible risk management in place. Identifying risks is a vitally important first step. Drafting a plan to minimize, mitigate, or even avoid pitfalls helps ensure success and prevent potential failures. That risk assessment exercise will highlight a risk/reward profile and enable an informed choice about which risks are likely to lead to reward and which should be avoided. New business owners must decide just how far along the spectrum of risk-taking they can tolerate and the types and level of risk they are willing to accept. What are your realistic chances of success?The first step to an actionable plan is to look at start-ups success/failure rates. According to the government’s Small Business Administration (SBA) agency, about half of all new businesses fail in the first five years. About one-third make it to the ten-year mark. These statistics are sobering, but you can significantly increase your chances of being one of the companies opened this month that make it to year ten. Start by breaking down the risk factors that can contribute to or undermine your success. What types of risk should you consider?Risks can be categorized. Most types of risk a new small business venture faces can be broken down into one of these:

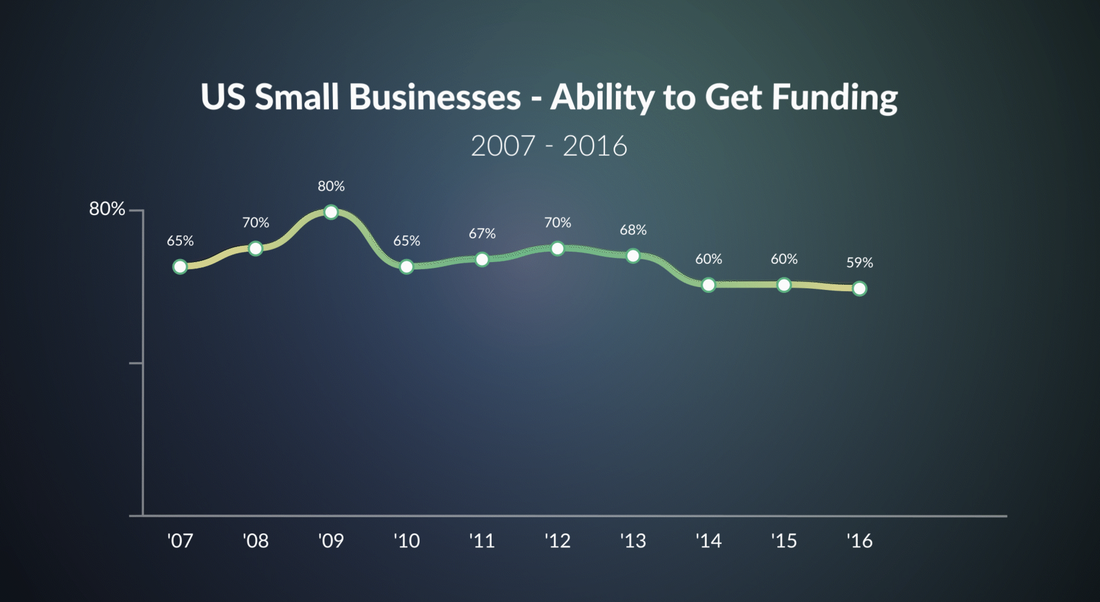

FINANCIAL Over 27% of companies were unable to secure start-up funding according to a survey by the National Small Business Association (NSBA). That means it is essential to develop a funding plan. This lays out how you will fund your new business and the likely financing terms. If you have an idea but are unsure where to start developing a business plan and obtaining financing, a small business development center can help. My personal experience as a banker leads me to believe that small business development centers are not appreciated for all of the help that they can provide to a new business owner. Some small business lenders may require a minimum amount of proven cash flow for you to qualify. This might make them a poor choice for entrepreneurs who want to use loan funds to start a brand new venture. Also, don't limit yourself to one kind of loan, consider different kinds of funding to ensure you'll have the resources you need to start or grow your business. Watch cashflow religiously because it can trip you up82% of failed businesses reported cash flow problems as a factor in closing shop. That’s according to a U.S. Bank study prepared by Jessie Hagan in 2019. It’s not only the initial start-up funding you need to plan for. Consider the situation should the business struggle to take off. In that case, cash flow will be sluggish. Be aware that cash flow is not just incoming revenues but also outgoing cash. Common issues impacting cash flow include past-due accounts receivable, cost of inventory, wasted inventory, and meeting the payroll on time. Conversely, rapid success can also cause issues. If sales grow faster than accounts receivable collection, it can also lead to constricted cashflow. Prepare for cash flow issues from the outsetAny lack of funding in place to cover these events can place the business owner’s personal assets at risk if they have personally guaranteed the debt. Unexpected or short-term cash flow needs can be mitigated by having a line of credit in place. It is critical to have a good relationship with a banker who understands your business and its risks, and who will work with you to develop a banking relationship that meets your needs. Look for a lender with a Credit Risk Certification (CRC) designation. This demonstrates in-depth knowledge in the area of risk. Sometimes risks are purposely not disclosed. Concealment or intentional hiding of risks can occur when you are purchasing another business or dealing with a predatory lender. Failing to disclose internal risks that are unknown to the market or alleged instances of predatory lending can lead to litigation, which often requires the services of an unfair and abusive loan/predatory lending expert witness. LEGALBefore you open the door or make that first sale, it is vital to understand the legal risks. First and foremost, you need a thorough understanding of which business structure best matches your business ownership. Is an LLC or a corporation the right legal structure for your business? Regulatory compliance, insurance risks, intellectual property, and workplace safety requirements are factors that you must consider. A proper understanding goes a long way to creating sustainable growth and minimizing potential events. Failure to do so could cause damage to your business and even your personal finances. In these matters, there is no substitute for consulting a trusted professional advisor, such as an accountant or attorney. Make sure to safeguard your growth by taking adequate steps to ensure the legal protection of your assets — especially in the start-up phase, when risks are most significant. Learn from the mistakes of othersThe type of business you are starting has very likely been previously started by others too. Learn from their mistakes. Look for research that discusses your industry and understand the risks and what others have done to mitigate them. Industry-related risks should be thoroughly considered and assessed alongside other factors in your business model and market. MARKETAsk yourself in what ways your business is different. They are your unique selling points (USPs) that will drive customers to you. A warning here — do not confuse your own enthusiasm for a product or service with market acceptance. Research your competitors to see how they are trying to improve their services. A successful business is one that can fulfill its customers’ needs first and foremost. If your services and products can’t do that, there is little chance that you will have staying power. TECHNOLOGYNew technology can eclipse a company’s edge in the market and become a significant problem. Companies may try to make operations work with technologies that are outdated or less than optimal, and many find themselves leap-frogged by a competitor’s offerings. This technological leaping can even obliterate the need for a company’s offerings. A good example is companies like Uber and Lyft, almost drowning out the taxicab industry in major cities. The advent of freelance dashing companies means more and more suppliers are no longer choosing to employ delivery drivers. Nowadays every company is impacted by technology. You need to continually and proactively update your offerings to meet the needs of the market. It means you must predict future growth within your niche to stay on top and stay in business. Make sure your marketing strategy shows that you are at the forefront of offerings in your field. Maintain a reliable, consistent presence and you will be ready to take on the risks that a fast-moving economy generates. ECONOMIC & POLITICALIntrinsically tied to the viability of any company is the economic health of its geographical presence. Factors like exchange rates, government regulation and political stability (or the perception thereof) significantly impact whether your offerings can compete in a global marketplace. While these factors might occasionally be a hardship, they can also be a significant source of opportunity. Local, national, and foreign regulations likely impose different requirements and so it is critical to understand the rules and regulations governing your product in the market where you intend to compete for customers. CONCLUSIONRisk is inevitable in business. A successful business owner balances acceptable risks with those that are unavoidable. When testing the viability of your business idea, do your best to envisage robust safeguards. Think defense as well as attack. A solid core team, business-friendly government regulatory environment, and competitive research of technological advantages are significant first steps. Ensure that your organization can generate engagement in a diverse group of marketing channels while placing a high priority on prudent financial management. A well-rounded but detailed big picture scrutiny of your potential for success can ground you in reality and ensure that your venture is ready and able to deliver on its promises. Business owners who feel they were the victims of predatory lending or deals in which the risks were intentionally concealed may seek redress through the courts. These cases often utilize an expert witness in abusive, unfair, and deceptive loan practices or experts with knowledge of the risks involved in that matter. An expert witness can be retained to investigate and offer opinions as to whether or not the alleged conduct was concealed or predatory lending.

He has served as an expert witness in cases involving commercial loans, residential mortgages, predatory lending, debt collection, underwriting, consumer protection, fraud, truth in lending, lender liability, loan servicing, deposit accounts, residential property valuation, risks associated with start-up ventures, and USPAP compliance. He has been engaged in multiple matters where predatory and abusive loan practices were alleged. Mr. Koontz has extensive testifying experience at deposition and trial.

Telephone: (646) 397–3835 Cell: (304) 541–5394 Website: www.jasondkoontz.com |

Jason D KoontzJason Koontz is a former bank Senior VP. He now serves as an expert witness in banking & real estate matters across the United States.. Archives

February 2024

Categories |

RSS Feed

RSS Feed