|

by Jason Koontz, CRC Opportunity and risk are two sides of the same coin when starting a new business. Entrepreneurs gain an edge when they grasp this basic concept and put sensible risk management in place. Identifying risks is a vitally important first step. Drafting a plan to minimize, mitigate, or even avoid pitfalls helps ensure success and prevent potential failures. That risk assessment exercise will highlight a risk/reward profile and enable an informed choice about which risks are likely to lead to reward and which should be avoided. New business owners must decide just how far along the spectrum of risk-taking they can tolerate and the types and level of risk they are willing to accept. What are your realistic chances of success?The first step to an actionable plan is to look at start-ups success/failure rates. According to the government’s Small Business Administration (SBA) agency, about half of all new businesses fail in the first five years. About one-third make it to the ten-year mark. These statistics are sobering, but you can significantly increase your chances of being one of the companies opened this month that make it to year ten. Start by breaking down the risk factors that can contribute to or undermine your success. What types of risk should you consider?Risks can be categorized. Most types of risk a new small business venture faces can be broken down into one of these:

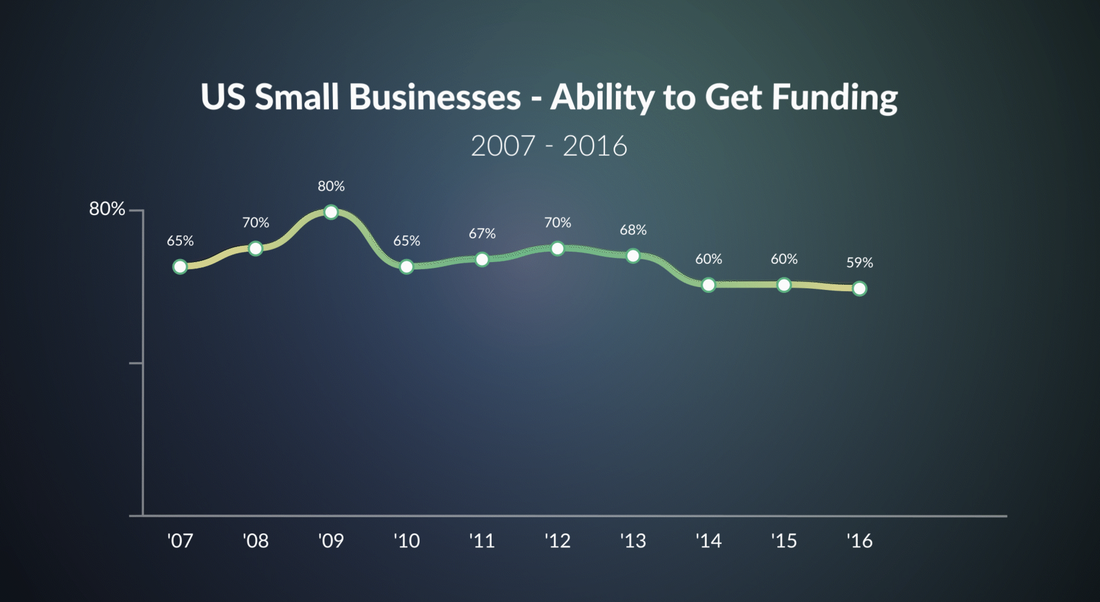

FINANCIAL Over 27% of companies were unable to secure start-up funding according to a survey by the National Small Business Association (NSBA). That means it is essential to develop a funding plan. This lays out how you will fund your new business and the likely financing terms. If you have an idea but are unsure where to start developing a business plan and obtaining financing, a small business development center can help. My personal experience as a banker leads me to believe that small business development centers are not appreciated for all of the help that they can provide to a new business owner. Some small business lenders may require a minimum amount of proven cash flow for you to qualify. This might make them a poor choice for entrepreneurs who want to use loan funds to start a brand new venture. Also, don't limit yourself to one kind of loan, consider different kinds of funding to ensure you'll have the resources you need to start or grow your business. Watch cashflow religiously because it can trip you up82% of failed businesses reported cash flow problems as a factor in closing shop. That’s according to a U.S. Bank study prepared by Jessie Hagan in 2019. It’s not only the initial start-up funding you need to plan for. Consider the situation should the business struggle to take off. In that case, cash flow will be sluggish. Be aware that cash flow is not just incoming revenues but also outgoing cash. Common issues impacting cash flow include past-due accounts receivable, cost of inventory, wasted inventory, and meeting the payroll on time. Conversely, rapid success can also cause issues. If sales grow faster than accounts receivable collection, it can also lead to constricted cashflow. Prepare for cash flow issues from the outsetAny lack of funding in place to cover these events can place the business owner’s personal assets at risk if they have personally guaranteed the debt. Unexpected or short-term cash flow needs can be mitigated by having a line of credit in place. It is critical to have a good relationship with a banker who understands your business and its risks, and who will work with you to develop a banking relationship that meets your needs. Look for a lender with a Credit Risk Certification (CRC) designation. This demonstrates in-depth knowledge in the area of risk. Sometimes risks are purposely not disclosed. Concealment or intentional hiding of risks can occur when you are purchasing another business or dealing with a predatory lender. Failing to disclose internal risks that are unknown to the market or alleged instances of predatory lending can lead to litigation, which often requires the services of an unfair and abusive loan/predatory lending expert witness. LEGALBefore you open the door or make that first sale, it is vital to understand the legal risks. First and foremost, you need a thorough understanding of which business structure best matches your business ownership. Is an LLC or a corporation the right legal structure for your business? Regulatory compliance, insurance risks, intellectual property, and workplace safety requirements are factors that you must consider. A proper understanding goes a long way to creating sustainable growth and minimizing potential events. Failure to do so could cause damage to your business and even your personal finances. In these matters, there is no substitute for consulting a trusted professional advisor, such as an accountant or attorney. Make sure to safeguard your growth by taking adequate steps to ensure the legal protection of your assets — especially in the start-up phase, when risks are most significant. Learn from the mistakes of othersThe type of business you are starting has very likely been previously started by others too. Learn from their mistakes. Look for research that discusses your industry and understand the risks and what others have done to mitigate them. Industry-related risks should be thoroughly considered and assessed alongside other factors in your business model and market. MARKETAsk yourself in what ways your business is different. They are your unique selling points (USPs) that will drive customers to you. A warning here — do not confuse your own enthusiasm for a product or service with market acceptance. Research your competitors to see how they are trying to improve their services. A successful business is one that can fulfill its customers’ needs first and foremost. If your services and products can’t do that, there is little chance that you will have staying power. TECHNOLOGYNew technology can eclipse a company’s edge in the market and become a significant problem. Companies may try to make operations work with technologies that are outdated or less than optimal, and many find themselves leap-frogged by a competitor’s offerings. This technological leaping can even obliterate the need for a company’s offerings. A good example is companies like Uber and Lyft, almost drowning out the taxicab industry in major cities. The advent of freelance dashing companies means more and more suppliers are no longer choosing to employ delivery drivers. Nowadays every company is impacted by technology. You need to continually and proactively update your offerings to meet the needs of the market. It means you must predict future growth within your niche to stay on top and stay in business. Make sure your marketing strategy shows that you are at the forefront of offerings in your field. Maintain a reliable, consistent presence and you will be ready to take on the risks that a fast-moving economy generates. ECONOMIC & POLITICALIntrinsically tied to the viability of any company is the economic health of its geographical presence. Factors like exchange rates, government regulation and political stability (or the perception thereof) significantly impact whether your offerings can compete in a global marketplace. While these factors might occasionally be a hardship, they can also be a significant source of opportunity. Local, national, and foreign regulations likely impose different requirements and so it is critical to understand the rules and regulations governing your product in the market where you intend to compete for customers. CONCLUSIONRisk is inevitable in business. A successful business owner balances acceptable risks with those that are unavoidable. When testing the viability of your business idea, do your best to envisage robust safeguards. Think defense as well as attack. A solid core team, business-friendly government regulatory environment, and competitive research of technological advantages are significant first steps. Ensure that your organization can generate engagement in a diverse group of marketing channels while placing a high priority on prudent financial management. A well-rounded but detailed big picture scrutiny of your potential for success can ground you in reality and ensure that your venture is ready and able to deliver on its promises. Business owners who feel they were the victims of predatory lending or deals in which the risks were intentionally concealed may seek redress through the courts. These cases often utilize an expert witness in abusive, unfair, and deceptive loan practices or experts with knowledge of the risks involved in that matter. An expert witness can be retained to investigate and offer opinions as to whether or not the alleged conduct was concealed or predatory lending.

He has served as an expert witness in cases involving commercial loans, residential mortgages, predatory lending, debt collection, underwriting, consumer protection, fraud, truth in lending, lender liability, loan servicing, deposit accounts, residential property valuation, risks associated with start-up ventures, and USPAP compliance. He has been engaged in multiple matters where predatory and abusive loan practices were alleged. Mr. Koontz has extensive testifying experience at deposition and trial.

Telephone: (646) 397–3835 Cell: (304) 541–5394 Website: www.jasondkoontz.com

0 Comments

Leave a Reply. |

Jason D KoontzJason Koontz is a former bank Senior VP. He now serves as an expert witness in banking & real estate matters across the United States.. Archives

February 2024

Categories |

RSS Feed

RSS Feed